We’ll consult to help you design a plan that fits the needs of your business and its employees. Then, we’ll administer your plan with the expertise only we can deliver.

Already have a company retirement plan? Let us evaluate your plan at no cost and we’ll let you know how we can make it better.

We are experienced.

In addition to our years of experience, we hold several highly recognized credentials including Certified Plan Fiduciary Advisor (CPFA), Chartered Financial Analyst (CFA®), Certified Financial Planner (CFP®), Certified Trust and Fiduciary Advisor (CTFA), Accredited Investment Fiduciary (AIF), Chartered Financial Consultant (ChFC®)and Registered Financial Consultant (RFC®).

We tailor investments uniquely to you.

We are client-focused. We ask questions, listen and then develop tailored investment solutions to meet your company’s unique needs. We manage your investments based on communication, sound fundamentals and prudence.

We are committed to your goals.

Your goals are our priority. As a fee-only trust organization, we have no bias toward any investment product or security. We always act in your best interest.

Our mission is two-fold:

• Meet your corporate objectives

• Place your employees on a financial path toward an enjoyable retirement.

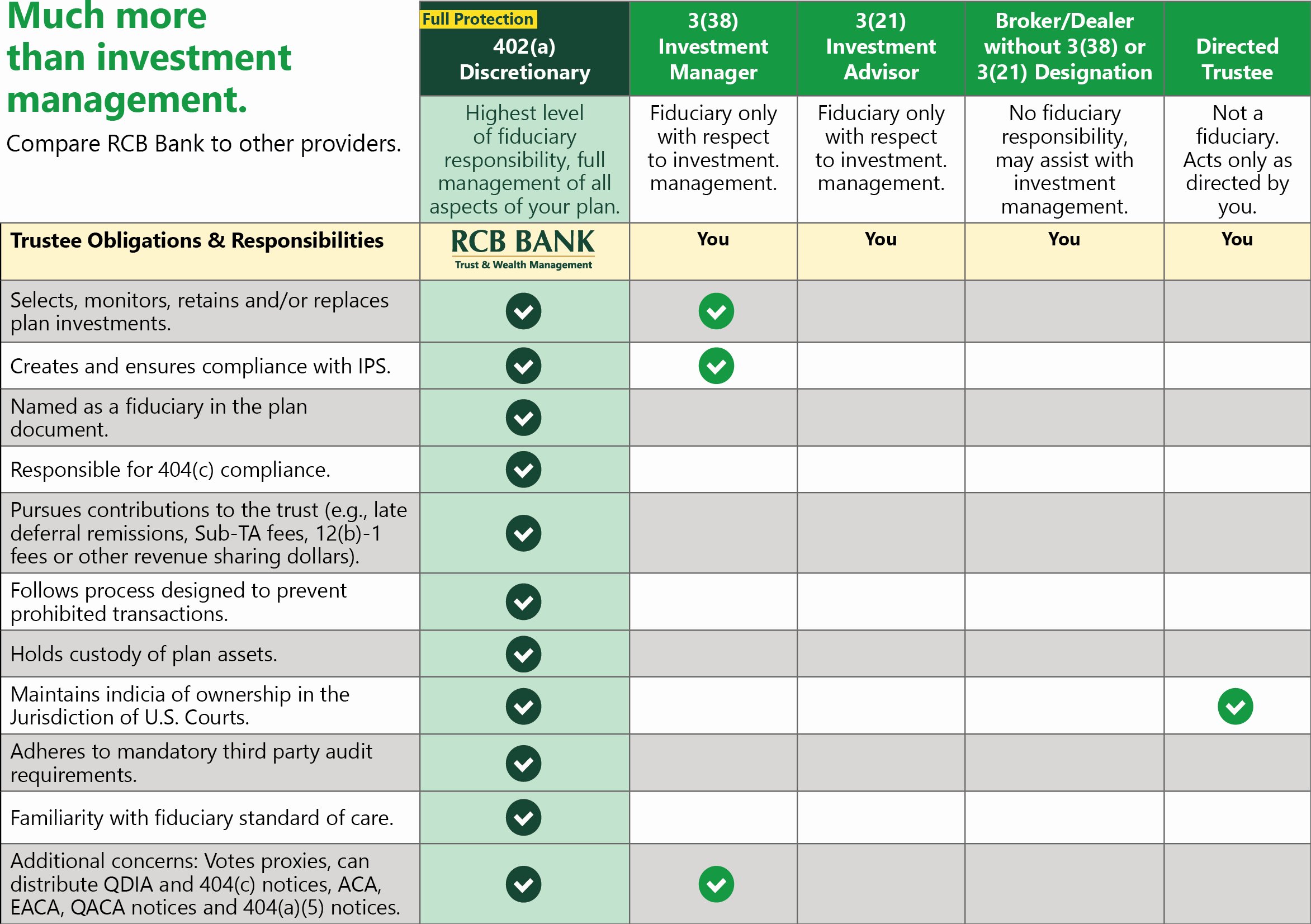

We offer much more than investment management.

This chart is an illustration of the Fiduciary Hierarchy under ERISA. Investment products are not insured by the FDIC. Not a deposit or other obligation of, or guaranteed by the depository institution. Subject to investment risks, including possible loss of the principal amount invested. Ask for details. REV 21-15799