Teaching teenagers about budgeting is essential for their financial literacy and independence. Here are some practical steps parents can take to guide their teens through this important process.

Start with Basics – Introduce the concept of budgeting as a monthly spending plan. Explain what a budget includes—income, necessary expenses and discretionary spending. Keeping it simple at first can help them grasp the fundamentals without feeling overwhelmed[1].

Encourage Earning – Make budgeting a family affair. Discuss household expenses and income openly, allowing your teen to see how financial decisions are made. This involvement can allow for a better understanding of budgeting and help them appreciate the complexities of managing money[3].

Set Up an Allowance – Consider giving your teen an allowance tied to specific responsibilities. This can teach them to manage their own money and understand the value of earning. Encourage them to budget their allowance for both needs and wants, reinforcing the importance of prioritizing spending[2].

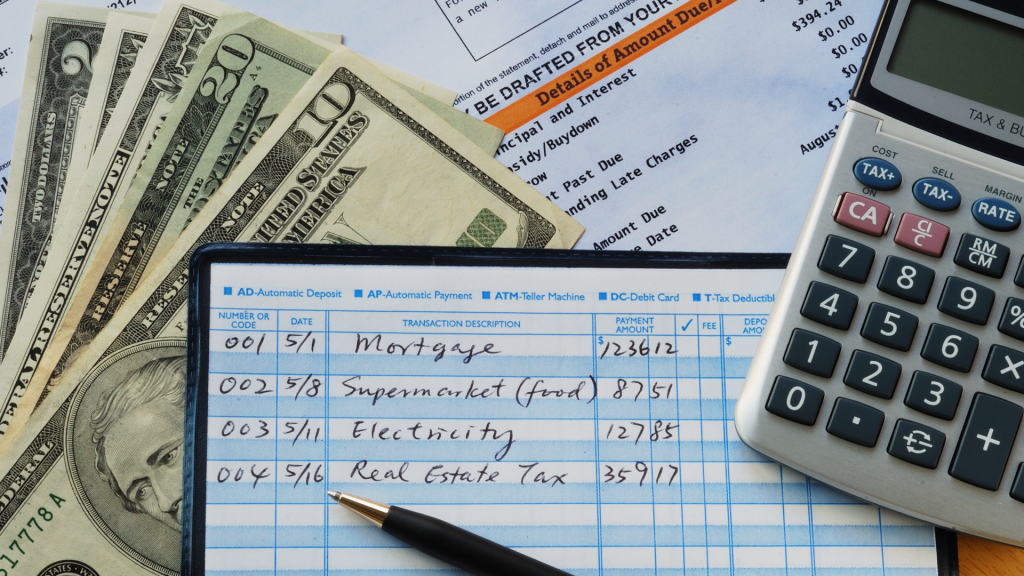

Create a Budget Together – Work with your teen to create their own budget. Start by calculating their total income, which may include allowances, gifts or part-time job earnings. Then, help them list their necessary expenses, such as phone bills or transportation costs. This hands-on approach helps them learn to balance income and expenses[3].

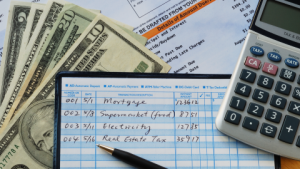

Use Budgeting Tools – Introduce your teenager to budgeting apps or templates that can help them track their spending. Visual aids can make budgeting more engaging and easier to manage. Alternatively, they can use simple pen-and-paper methods to write down their budget categories[1].

Encourage Saving – Teach your teen to prioritize savings by incorporating it into their budget. Encourage them to set savings goals for larger purchases or future expenses, emphasizing the importance of “paying themselves first” before spending on discretionary items[3].

By following these steps, parents can equip their teenagers with the skills they need to budget effectively, paving the way for a financially responsible future.

Ready to open an account to help your child get started? For Kids Club Checking* visit RCBbank.bank/Kids-Club/ . For Kids Club Savings* visit RCBbank.bank/Kids-Savings/

The opinions expressed above are the personal opinions of the author and meant for generic illustration purposes only. RCB Bank. Member FDIC. * Kids Club accounts are for individuals under the age of 18, and a parent or guardian is required to be joint owner or custodian on the account. Ask us for details. A monthly fee will be assessed for accounts receiving a paper statement. Member FDIC

Sources:

[1] https://www.gohenry.com/us/blog/financial-education/how-to-teach-your-teenager-about-budgeting

[2] https://www.knockedupmoney.com/blog/building-financial-literacy-in-teens-in-6-steps