You may not feel comfortable getting your teen a credit card right now, but it is never too early to talk about the benefits and risks of having one.

Credit Cards Are Not Free Money

Credit cards are a line of credit. This means they are debt until the bill is paid. Read the fine print on your credit card bill with your teen. Explain how quickly interest and late fees add up, and the burdens of long-term debt. “Teens need to learn the risks of credit cards,” cautions RCB Bank Mortgage personnel. “They need to learn how to be responsible and not over extend credit.”

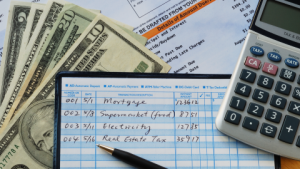

Learn How to Budget Expenses

“Before you discuss credit cards, teach your teens how to create a budget,” says RCB Bank Wealth Advisor Cathy Sang. Talk about bills and monthly expenses and how you manage them. Better yet, create a budget with your teen using an average beginning career income. Determine how much can be spent on bills and extras, such as shopping or eating out. This will teach them how to plan for and manage their expenditures, so they don’t overextend credit.

Credit Reports & Credit Scores Matter

Talk to your teen about credit reports and how they offer details on how people manage money. This is important for when they want to buy a car, for example. Explain how credit scores impact their ability to get lower loan and insurance rates. “Kids need to understand the importance of building a good credit history early,” says RCB Bank Wealth Advisor Mary Wood. “Using a credit card wisely, by paying off the balance each month, can help improve their future credit score.”

Opinions expressed above are the personal opinions of the author and meant for generic illustration purposes only. Member FDIC.