Homebuyers in 2025 face a challenging landscape: home prices are expected to keep rising, though at a slower pace, and mortgage rates remain elevated, hovering near 7%. Inventory is improving but still below balanced market levels and affordability remains a top concern for many Americans. While waiting for a dramatic drop in prices or rates is unlikely to pay off, there are practical strategies buyers can use to navigate these conditions.

First, consider expanding your search to markets with more inventory or where prices are stabilizing or even declining. Some regions, such as parts of Texas and Florida, are seeing price drops due to increased supply, while others-especially in the Northeast-continue to experience price growth. Flexibility on location could yield better value.

Second, explore mortgage options beyond the traditional 30-year fixed loan. Adjustable-rate mortgages (ARMs) or shorter-term loans may offer lower initial rates, which could be advantageous if you expect rates to fall in the coming years or plan to refinance. Additionally, many builders are offering incentives, including rate buydowns or price reductions, which can help offset higher borrowing costs.

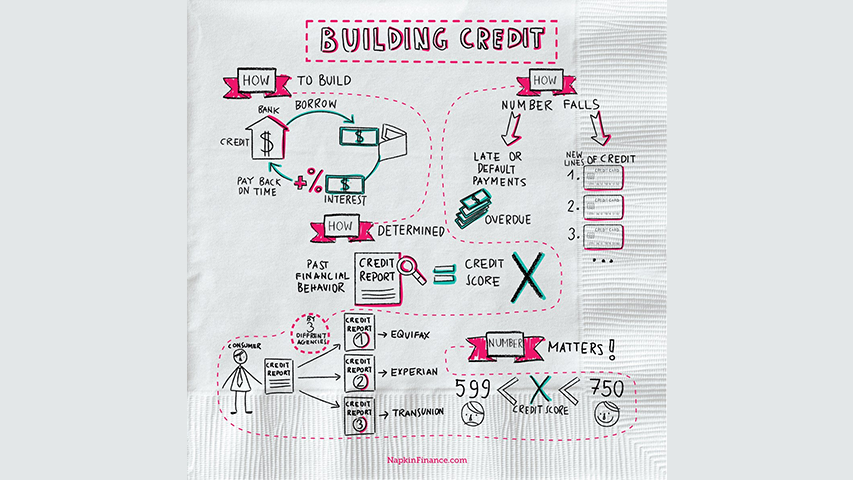

Lastly, strengthen your financial profile. A higher down payment, improved credit score and pre-approval can make you a more attractive buyer and potentially secure better loan terms. In a competitive market, being ready to act quickly is essential.

Contact one of our Mortgage Representatives today to assist you in meeting your homeownership goals!

Opinions expressed above are the personal opinions of the author and meant for illustration purposes only. For specific questions regarding your personal lending needs, please call RCB Bank at 855-BANK-RCB. With approved credit. Terms, qualifications and other restrictions apply. Member FDIC, Equal Housing Lender, RCB Bank NMLS #798151.

Sources:

- https://www.forbes.com/advisor/mortgages/real-estate/housing-market-predictions/

- https://www.pbs.org/newshour/economy/will-2025-be-a-better-year-to-buy-a-house-heres-what-experts-predict

- https://www.fanniemae.com/newsroom/fannie-mae-news/higher-mortgage-rates-likely-keep-existing-home-sales-near-multi-decade-lows

- https://247wallst.com/personal-finance/2025/04/17/housing-bubble-or-bust-whats-next-for-home-prices-in-2025/